irshivideos.com

WhatsApp e Threads, perché il governo cinese li ha fatti rimuovere dall’App Store?

L’annuncio ufficiale viene dalla Apple, la Cina ha rimosso WhatsApp e Threads dall’App Store, ecco cosa è successo Il governo cinese ha preso una decisione …

News

Google ha licenziato 28 dipendenti che hanno protestato contro l’accordo sul cloud con Israele

La nota del responsabile della sicurezza globale di Google: “Un comportamento del genere viola chiaramente … Leggi tutto

Spotify, in arrivo il piano Music Pro: ecco cosa conterrà

Spotify sta lavorando su alcune funzionalità di remix simili a quelle di TikTok. Questi strumenti … Leggi tutto

Amica Chips scandalizza con le patatine al posto dell’ostia, ma in passato ci sono state altre pubblicità controverse

Pensate che tutte le pubblicità siano uguali e noiose? Non sempre è così! Ecco alcuni … Leggi tutto

Disney+ segue l’esempio di Netflix: in arrivo una stretta sulle password condivise

Disney+ restringe la condivisione degli account: il “gratis” sta per finire. In arrivo nei prossimi … Leggi tutto

Gmail, presto su Android sarà possibile riassumere le email con l’IA

Attualmente Google non ha specificato quando potremo iniziare a utilizzare la nuova funzionalità che riassume … Leggi tutto

Chi è Emanuele Orsini, il nuovo presidente di Confindustria

Il 23 maggio, nell’Assemblea privata, il 51enne imprenditore Emanuele Orsini verrà eletto ufficialmente come nuovo … Leggi tutto

Gossip

Mariah Carey e Lenny Kravitz si stanno frequentando?

A un primo sguardo, quella tra Mariah Carey e Lenny Kravitz sembrerebbe una relazione improbabile, … Leggi tutto

Circolano voci su una relazione tra Geolier e Maria Esposito, ma loro negano

Sarà scoccato l’amore tra il rapper napoletano e la star di Mare Fuori? Ecco le … Leggi tutto

Kategate, quando il gossip si trasforma in complottismo

La storia della principessa Kate, dalla presunta scomparsa alla foto ritoccata, ci lascia solo una … Leggi tutto

Kate Middleton, la foto ritoccata e le scuse della principessa

Una foto della principessa Kate Middleton sta facendo scandalo, scopriamo cosa succede e perché è … Leggi tutto

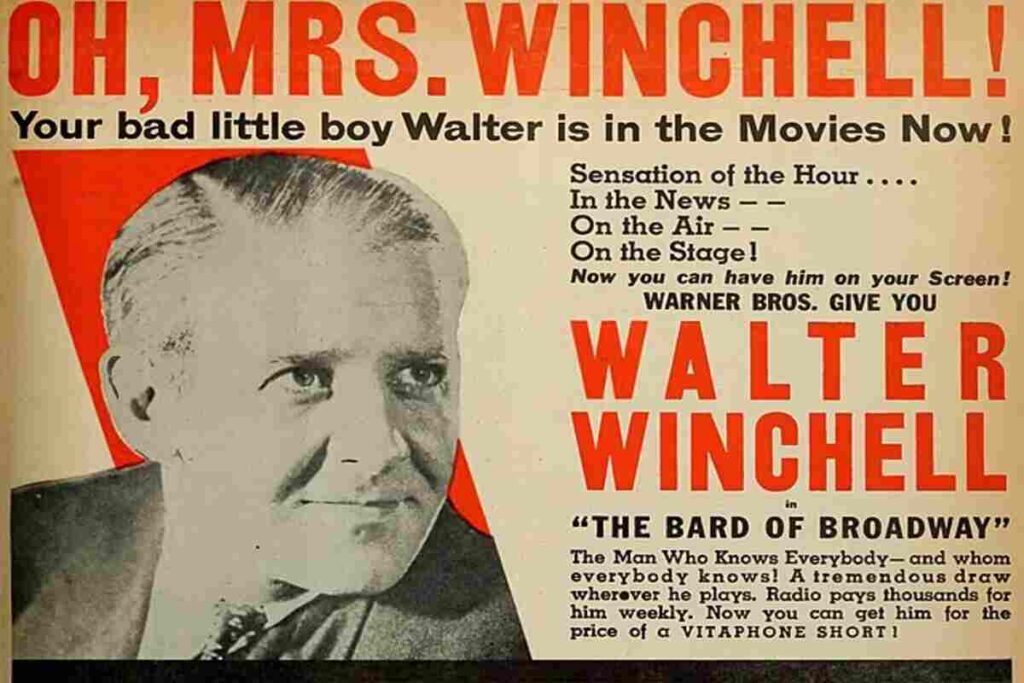

Il gossip ha un padre e il suo nome è Walter Winchell

A tutti piace il gossip e chi lo nega mente. Scopriamo chi era davvero Walter … Leggi tutto

Royal Family, gli ultimi aggiornamenti tra certezze e gossip selvaggio

Un 2024 fino ad oggi molto complicato quello vissuto dalla Royal Family. Tra le condizioni … Leggi tutto