irshivideos.com

Intelligenza artificiale: come riconoscere un’immagine generata dall’IA

All’intelligenza artificiale bastano 13 millisecondi per elaborare un’immagine, ma osservando con attenzione si può rimanere sorpresi Le immagini fake stanno diventando sempre più realistiche con il passare del …

News

Il Cdm ha approvato un disegno di legge sull’Ia: cosa prevede?

Il testo chiarisce che l’utilizzo dell’intelligenza artificiale non deve pregiudicare la vita democratica del Paese … Leggi tutto

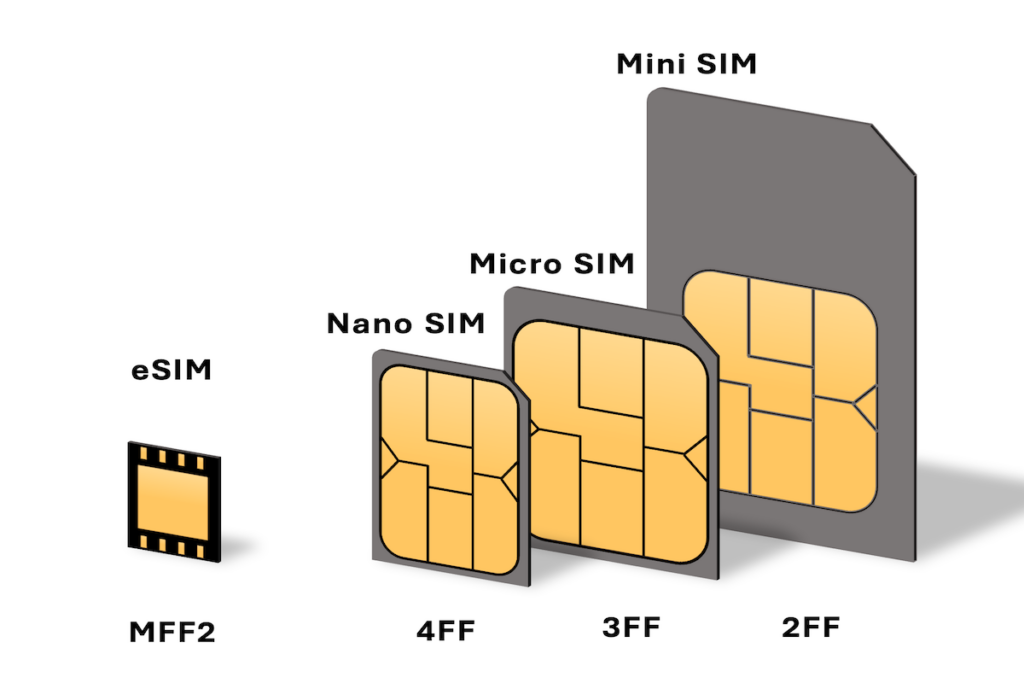

Le SIM fisiche spariranno per sempre?

Il futuro delle sim fisiche, insomma, è fortemente in bilico, nonostante gli 8,3 miliardi di pezzi … Leggi tutto

Google ha licenziato 28 dipendenti che hanno protestato contro l’accordo sul cloud con Israele

La nota del responsabile della sicurezza globale di Google: “Un comportamento del genere viola chiaramente … Leggi tutto

Spotify, in arrivo il piano Music Pro: ecco cosa conterrà

Spotify sta lavorando su alcune funzionalità di remix simili a quelle di TikTok. Questi strumenti … Leggi tutto

Amica Chips scandalizza con le patatine al posto dell’ostia, ma in passato ci sono state altre pubblicità controverse

Pensate che tutte le pubblicità siano uguali e noiose? Non sempre è così! Ecco alcuni … Leggi tutto

Disney+ segue l’esempio di Netflix: in arrivo una stretta sulle password condivise

Disney+ restringe la condivisione degli account: il “gratis” sta per finire. In arrivo nei prossimi … Leggi tutto

Gossip

Giano Del Bufalo ha una relazione con Giulia De Lellis? Ecco le ultime notizie

Giulia De Lellis fatica a stare da sola e questa volta potrebbe aver puntato il … Leggi tutto

Mariah Carey e Lenny Kravitz si stanno frequentando?

A un primo sguardo, quella tra Mariah Carey e Lenny Kravitz sembrerebbe una relazione improbabile, … Leggi tutto

Circolano voci su una relazione tra Geolier e Maria Esposito, ma loro negano

Sarà scoccato l’amore tra il rapper napoletano e la star di Mare Fuori? Ecco le … Leggi tutto

Kategate, quando il gossip si trasforma in complottismo

La storia della principessa Kate, dalla presunta scomparsa alla foto ritoccata, ci lascia solo una … Leggi tutto

Kate Middleton, la foto ritoccata e le scuse della principessa

Una foto della principessa Kate Middleton sta facendo scandalo, scopriamo cosa succede e perché è … Leggi tutto

Il gossip ha un padre e il suo nome è Walter Winchell

A tutti piace il gossip e chi lo nega mente. Scopriamo chi era davvero Walter … Leggi tutto