irshivideos.com

Perché la condanna di Harvey Weinstein è stata annullata?

Le accuse di molestie sessuali potrebbero essere cadute. Ecco la verità sul caso Harvey Weinstein e l’errore del giudice Nel 2020 Harvey Weinstein, famoso produttore …

News

Perché la condanna di Harvey Weinstein è stata annullata?

Le accuse di molestie sessuali potrebbero essere cadute. Ecco la verità sul caso Harvey Weinstein … Leggi tutto

Android TV e gli accessi indesiderati a Gmail: cosa succede?

Alcuni modelli di Android TV potrebbero mettere a rischio la privacy degli utenti, ecco cosa … Leggi tutto

Il Cdm ha approvato un disegno di legge sull’Ia: cosa prevede?

Il testo chiarisce che l’utilizzo dell’intelligenza artificiale non deve pregiudicare la vita democratica del Paese … Leggi tutto

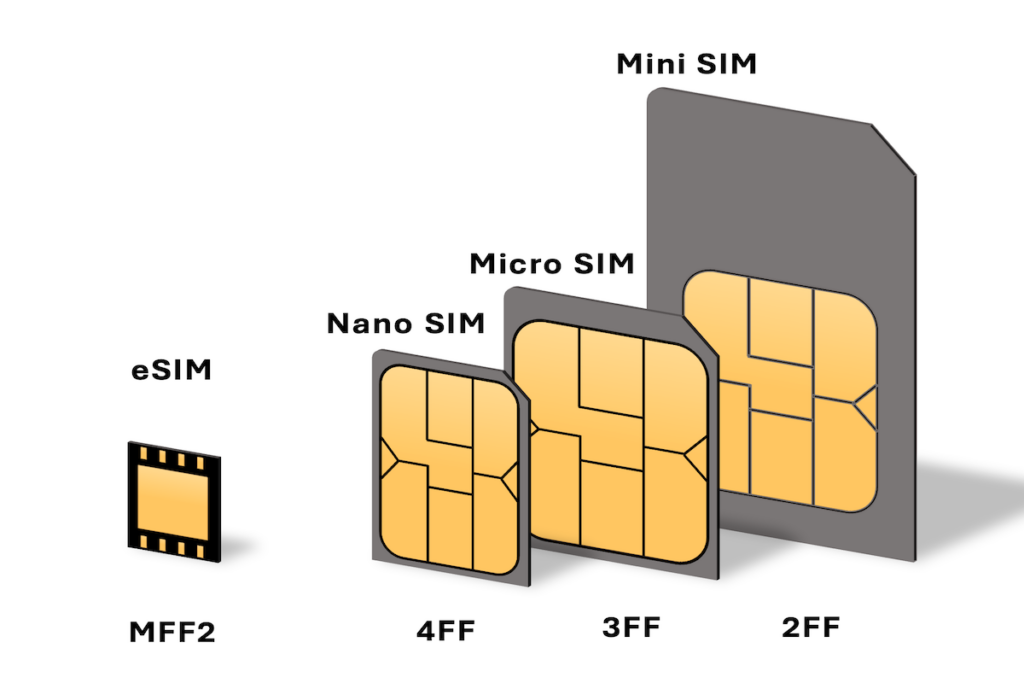

Le SIM fisiche spariranno per sempre?

Il futuro delle sim fisiche, insomma, è fortemente in bilico, nonostante gli 8,3 miliardi di pezzi … Leggi tutto

Google ha licenziato 28 dipendenti che hanno protestato contro l’accordo sul cloud con Israele

La nota del responsabile della sicurezza globale di Google: “Un comportamento del genere viola chiaramente … Leggi tutto

Spotify, in arrivo il piano Music Pro: ecco cosa conterrà

Spotify sta lavorando su alcune funzionalità di remix simili a quelle di TikTok. Questi strumenti … Leggi tutto

Gossip

Giano Del Bufalo ha una relazione con Giulia De Lellis? Ecco le ultime notizie

Giulia De Lellis fatica a stare da sola e questa volta potrebbe aver puntato il … Leggi tutto

Mariah Carey e Lenny Kravitz si stanno frequentando?

A un primo sguardo, quella tra Mariah Carey e Lenny Kravitz sembrerebbe una relazione improbabile, … Leggi tutto

Circolano voci su una relazione tra Geolier e Maria Esposito, ma loro negano

Sarà scoccato l’amore tra il rapper napoletano e la star di Mare Fuori? Ecco le … Leggi tutto

Kategate, quando il gossip si trasforma in complottismo

La storia della principessa Kate, dalla presunta scomparsa alla foto ritoccata, ci lascia solo una … Leggi tutto

Kate Middleton, la foto ritoccata e le scuse della principessa

Una foto della principessa Kate Middleton sta facendo scandalo, scopriamo cosa succede e perché è … Leggi tutto

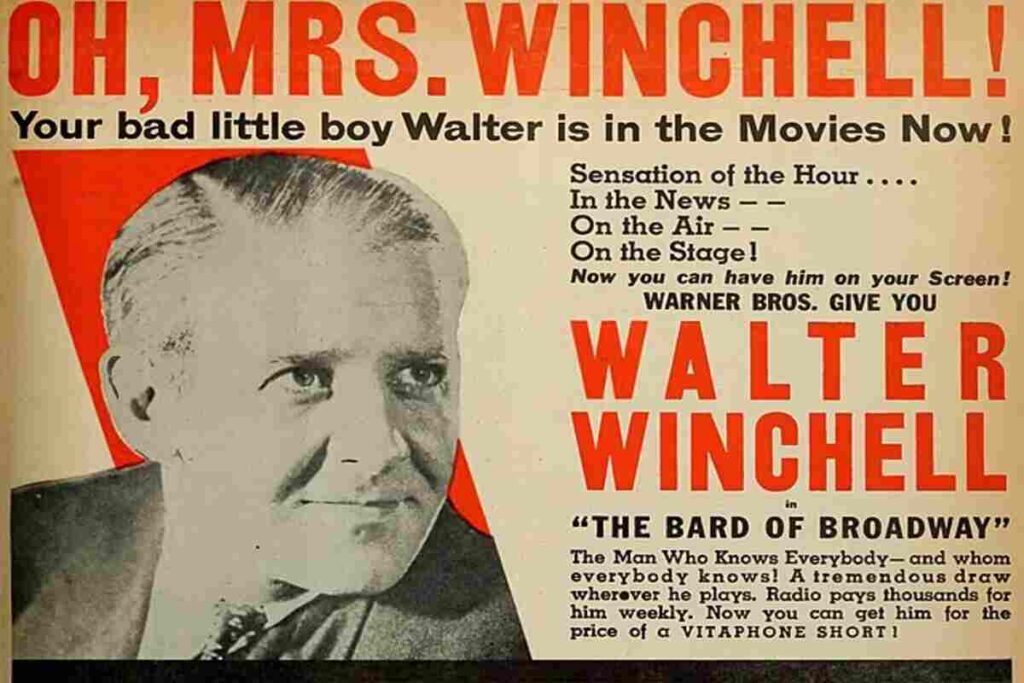

Il gossip ha un padre e il suo nome è Walter Winchell

A tutti piace il gossip e chi lo nega mente. Scopriamo chi era davvero Walter … Leggi tutto